marin county property tax due dates 2021

Search Marin County Records Online - Results In Minutes. Marin County collects on average 063 of a propertys assessed fair market value as property tax.

Property Tax California H R Block

First Installment of Property Taxes Due Monday 121216.

. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. Ad Find Marin County Online Property Taxes Info From 2021. 1st Installment of Property Taxes Delinquent after December 10th.

21 rows First installment secured real property taxes due. Once completed return the form by May 31 2021 to. First day to file claim for homeowners or disabled veterans exemption.

The total assessed value on my 2020-2021 property tax bill is 650000. 10 to avoid penalty. Property tax statements are mailed before October 25 every year.

Please consult your local tax authority for specific details. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. Online or phone payments recommended by Tax Collector.

Reply 1 The first installment of property taxes is due Nov. The normal office hours are 9am to 430 pm weekdays. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. Lien date for all taxable property. Tax Rate Book 2021-2022.

While the county is NOT delaying the April 10 due date for property tax payments the tax collector has announced they are. Duplicate bills are available on request. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

Both installments may be paid with the first installment. Taxpayers are being asked to pay online by phone or by mail. Your property in this example does not qualify for Proposition 8 relief as the assessed value is lower than the market value.

Property Tax Rate Books. Send the correct installment payment stub 1st or 2nd when paying your bill. Property Tax Function Important Dates January 2022.

You must file your request by May 31 2021. See your tax bill for details. If the 15th falls on a weekend or holiday due date is the next business day.

San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm. Marin County collects on average 063 of a propertys assessed fair market value as property tax. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes.

September 28 2021 at 411 pm. If you purchased your property in 2010 for 500000 but on January 1 2020 its market value was 425000 it may be subject to a temporary reduction in value for the lien date January 1 2020 affecting the property tax value for the regular tax bill due in fiscal year 202021. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

If you qualify please complete and sign the Declaration of Exemption to City of Mill Valley 2021-22 Library Tax Form on the reverse side of this page. Pay your taxes in full by November 15 or make partial payments with further installments due in February and May. This type of property tax relief generally applies to more recently purchased property.

First day to file the Business Property Statement if required or requested with your county assessor last day to file without penalty is May 9. If you need additional information please contact the Marin County Assessors Office. Property tax due dates are not expected to change as a result of the COVID-19 pandemic.

All secured personal property taxes. A form will automatically be sent to those who filed the previous year. 1 and must be paid on or before Dec.

This coming Monday December 12 is the last day to pay the first installment of Marin County property taxes. The second installment must be paid by April 10 2021. Penalties apply if the installments are not paid by December 10 or April 10 respectively.

County of Marin MARIN COUNTY CA Marin Countys 2020-21 property tax. The Tax Collector is located at 3501 Civic Center Drive Room 202 in San Rafael. Revised tax bills may have different due dates so.

Senior Low-Income Exemption Measure K L - To qualify for a 3600 Senior Low-Income Exemption for a single family residence you must be 65 years of age or older by December 31 of the tax year 2021 own and occupy your residence located in the Special Tax Zone 2 of the Marin County Free Library District or the Town of Corte Madera and earn a total annual household. Taxes collected in 2022 represent the real estate tax obligations from 2021. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Marin County.

Monday April 12 a date not expected to change due to the COVID-19 pandemic. The market value of my property on January 1 2020 was 740000. Homeowner Bs property tax bill will be based on the actual market value of 850000 since it is lower than the factored base year value of 949000.

Local property tax revenues are needed now more than ever. Pay Property Taxes by April 12. September 27 2021 at 642 pm.

Marin County Tax Collector P. If you have questions about the following information please contact the Property Tax Division at 415 473-6168. Marin County taxpayers are being asked to pay online by phone or by mail rather than in-person.

Marin County property tax update. Property Tax Bill Information and Due Dates. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 1.

You must reapply each year to keep the exemption in effect. San Rafael CA Marin Countys 2020-21 property tax bills 91184 of them were mailed to property owners September 25. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days.

AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements. The tax year runs from January 1st to December 31st.

Marin County Mails Property Tax Bills Seeking 1 26b

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

California Proposition 60 And Proposition 90 Transfer Of Base Property Tax

7 Things That Can Drive Your Property Taxes Up Aviara Real Estate

High Property Taxes Why You Re Paying So Much Money

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

115 Real Estate Infographics Use To Ignite Your Content Marketing Updated In 2021 Real Estate Infographic Real Estate Tips Getting Into Real Estate

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

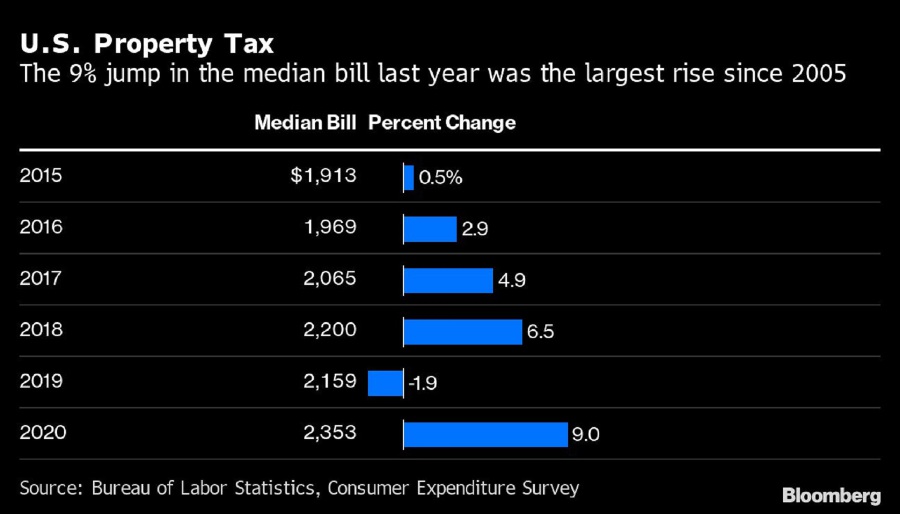

Homeowners Prepare For A Shocking Property Tax Bill Marketwatch

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Rpc Property Tax Advisors Home Facebook

Rpc Property Tax Advisors Home Facebook

Californians Adapting To New Property Tax Rules

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Homeowners Prepare For A Shocking Property Tax Bill Marketwatch

Historic Home Prices To Whack Owners In Next Year S Property Tax

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates